DataHack for Financial Inclusion (DataHack4FI) is an innovation competition from insight2impact that encourages skills development, collaboration and the use of data and data analytics to solve financial inclusion challenges. The initiative seeks to create innovation communities by convening fintechs, data fellows, innovation hubs, development partners and financial service providers to stimulate the use of data for financial inclusion. These pan-African communities create an enabling environment that improves financial access and, through innovative tech, promotes the use of formal financial services.

In DataHack4FI Season 2, young innovators and aspiring data scientists from six African countries were paired with fintechs to enhance their use of data in order to design innovative solutions and products.

Finding 1: Adopting a data-driven approach positively affects a fintechs’ potential for success

Fintechs describe several benefits associated with an enhanced data-centricity. Fintechs most commonly report that adopting this approach allowed them to:

- better understand their customers and design solutions that more closely meet their customers’ needs

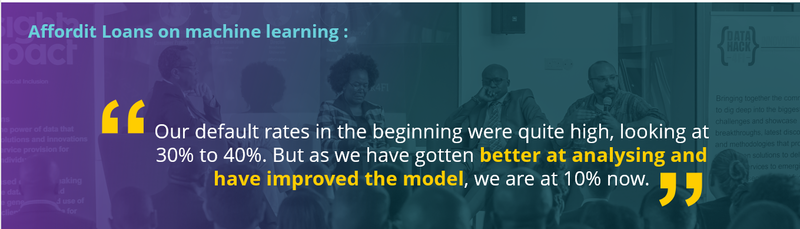

- improve the extent to which their models are able to accurately predict an output for a given use case

- gain additional insight that influences the strategic direction of their business, or that reaffirms their current strategy

- identify new market segments to target product innovations

Finding 2: DataHack4FI affected data fellows’ career prospects

Although all the data fellows interviewed stated that DataHack4FI Season 2 had motivated them to pursue a career in data science, the employment opportunities with the fintechs were limited. That being said, after the competition all of the data fellows were able to introduce some element of data science principles into their current positions.

Finding 3: Innovative data and analytics were used to design financial inclusion solutions

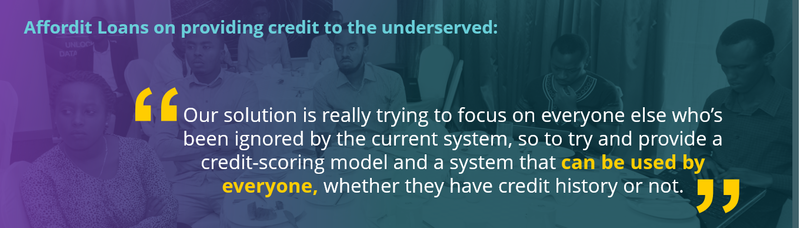

By employing a user-centred approach to solution design, the DataHack4FI teams were able to design solutions that advance financial inclusion by meeting the needs of their target population. Over the course of the competition the teams were able to clearly identify and articulate who their end customer is, understand the nature of their particular use case, and design innovative solutions that address these unique financial inclusion challenges. In a number of instances, the adoption of a data-centric approach influenced the number of customers a solution could impact.

Finding 4: Promoting data-driven product design and decision-making affects financial inclusion

The solutions developed during DataHack4FI Season 2 have the potential to, or are already, change the lives of financially underserved or unserved Africans across the continent. The competition successfully stimulated the use of data by participating fintechs thereby ensuring the solutions developed during the competition have a foundation in data and are designed to meet the needs of their target population.

DataHack4FI Season 2 encouraged skills development and collaboration to promote the use of data and innovative data analytics to solve financial inclusion challenges. Overall, 180 individuals participated in the pan-African innovation competition, representing 38 teams competing across six countries. The initiative was able to catalyse the development of 38 innovative solutions that sought to address financial inclusion challenges faced by millions of Africans across the continent. Of the 38 solutions, 14 targeted the financial inclusion of women and youth specifically. With Season 3’s finals just around the corner, we can’t wait to see what will happen next.

If you would like to know more about the DataHack4FI competition, you can find it here, or you can follow along with Season 3 using #DataHack4FI on Twitter.