In the beginning, there was the bank account – a useful dispenser of transactional services. More recently, however, the financial services industry innovated and introduced mobile money as a disruptive financial service.

Classic case of déjà vu – lessons from Kenya

Kenya was among the early adopters and pioneers in the mobile money space, thanks to its revolutionary M-Pesa. As of the second quarter of 2023[1], M-Pesa reportedly increased its revenue by 34.4% and gained 400,000 new customers in Kenya. This feat was primarily driven by the savings and credit offerings of the giant telecommunications company, Vodacom. With an approximate 51 million customer base in seven countries, the success of M-Pesa seemed to be contagious, extending its influence to the West African country of Ghana.

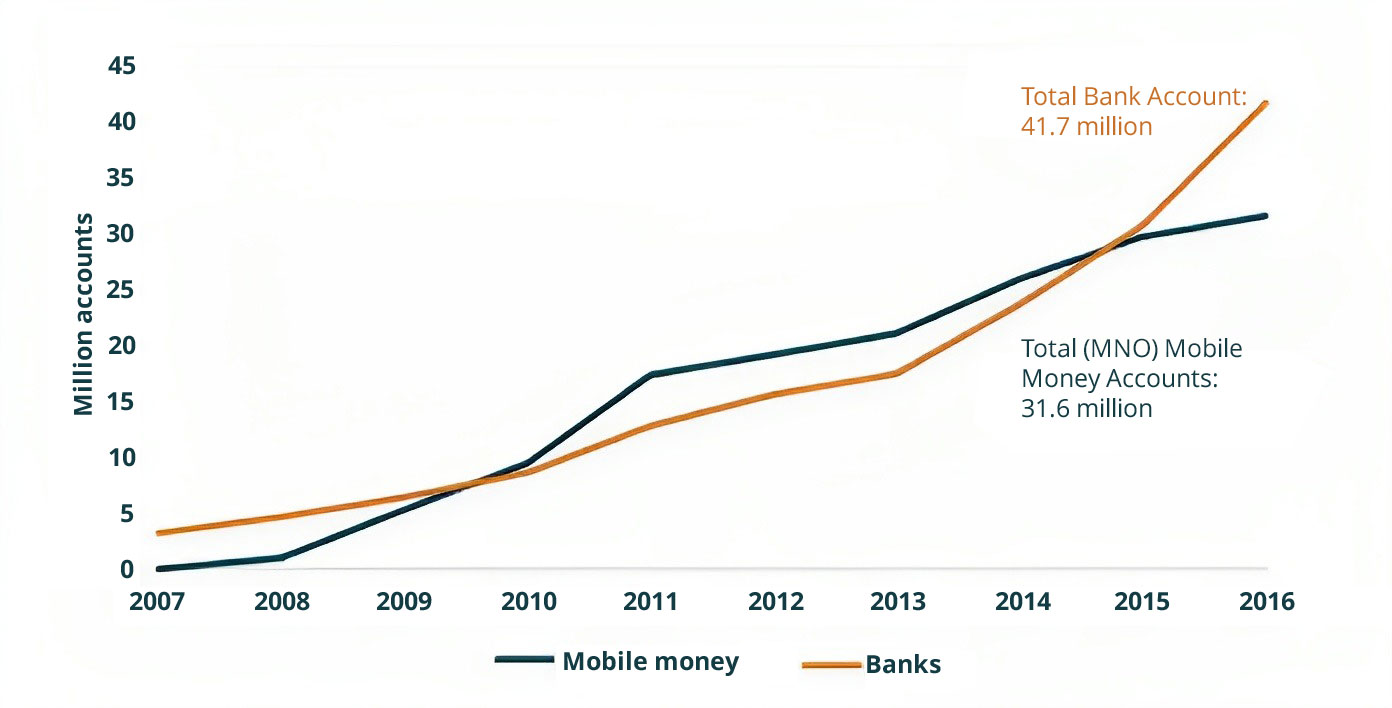

Figure 1:Total accounts of Kenyan Banks and Mobile Network Operators, 2006 – 2015

Source: www.cgap.org

As indicated in the figure above, Kenya’s bank employed two main strategies to regain its previous dominance in transactional accountants. The first strategy involved direct competition with mobile money through the introduction of innovative offerings, with Equitel being a classic example. The second strategy focused on developing partnerships with mobile network operators, with CBA and Safaricom as prime examples. Could this be a case of déjà vu for Ghana?

What makes Ghana special?

The evolution of the Ghanaian financial sector presented all the symptoms and signs of emulating the impressive success of M-Pesa. In 2009, MTN launched the first mobile money service in partnership with universal banks, followed by Airtel Money in 2010 and Tigo Cash in 2012. Notably, in 2019, Airtel Money and Tigo Cash merged under the new name AirtelTigo [2]

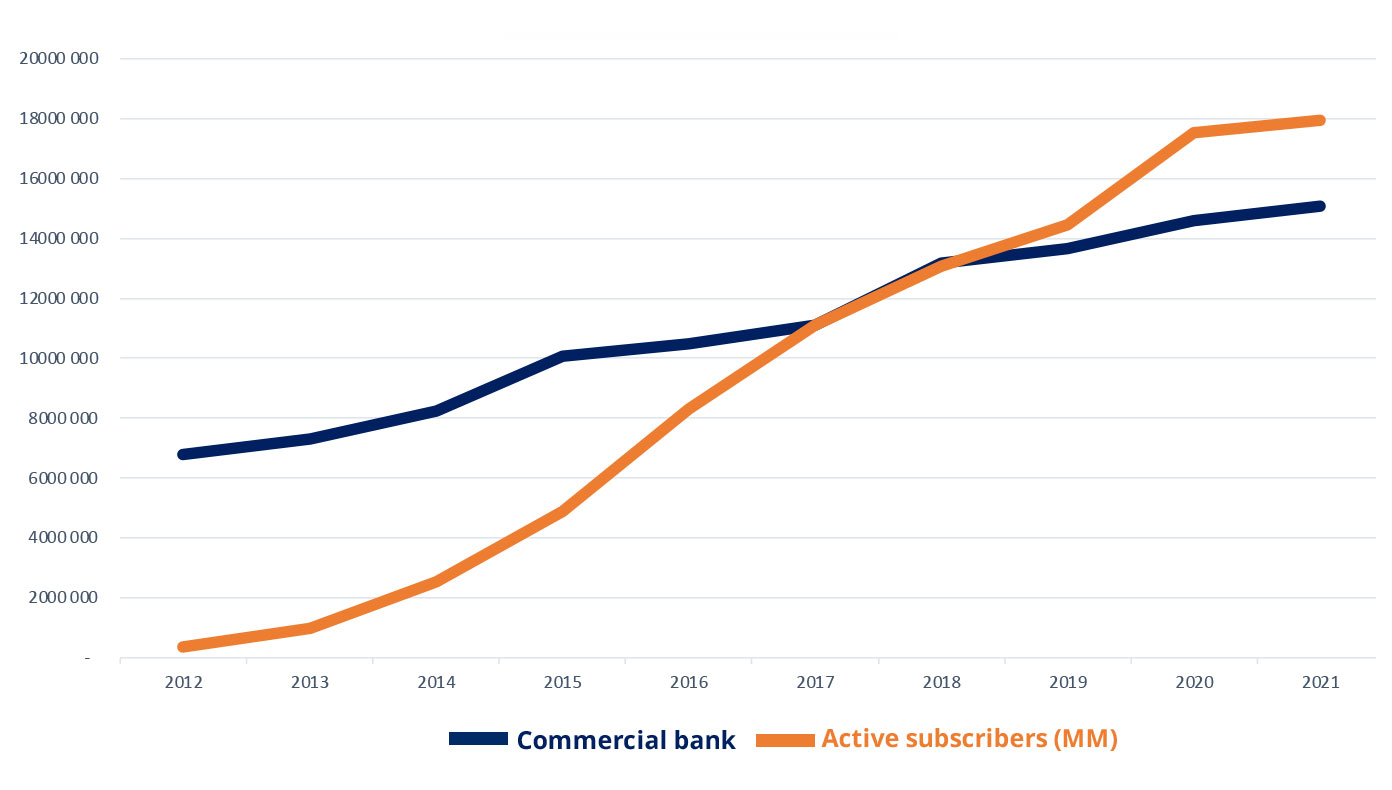

Figure 2: Ghana bank accounts versus active mobile money accounts

Source: Bank of Ghana, 2021

According to the Ghana Demand-side Survey 2021, the uptake of mobile money surged to 87% among all adults in 2021, whereas bank account penetration was only at 30%. However, the number of active mobile money subscribers accounted for around 18 million accounts. The figure above shows that the inflexion point, where mobile accounts surpassed bank accounts, occurred in 2018.

With the implementation of new strategies by Kenyan banks and the active competitive environment advanced by mobile network operators, several questions have arisen for Ghana:

- How are the banks reacting to this change in status quo?

- Could Ghana become a fully mobile money-led financial environment? In other words, will the future of the financial sector more likely rely on mobile money rails rather than bank rails?

- Unlike Kenya, could Ghana establish a new learning environment where mobile money may be viewed as a primary financial service provider?

- Are mobile network operators and banking institutions competitors or complementary providers?

Financial inclusion has accelerated since the advent of mobile money, primarily due to its reach and boundless distribution of mobile money agents. As a result, even the most remote areas can now be served and financially included. Ghana has witnessed extraordinary progress in financial inclusion since 2010, all thanks to the widespread adoption of mobile money. From a financial services perspective, the future of Ghana is one to watch, especially considering that the developments are more favourable for the utilisation of mobile money rails than traditional bank rails.

[1] https://technext24.com/2023/07/24/m-pesa-growth-revenue-gains-400-customer/